Contents

- 1 Salesforce Stock Analysis 2025 – Growth, AI Bets & Buy the Dip?

- 2 📌 Introduction

- 3 💼 Company Overview

- 4 📉 2025 Stock Performance

- 5 🤖 AI Momentum: Agentforce Is the Next Big Bet

- 6 💰 Acquisition Strategy: Bold or Risky?

- 7 📊 Analyst Sentiment

- 8 📈 Valuation Snapshot

- 9 🛒 Should You Buy the Dip?

- 10 🧠 Final Verdict

- 11 📌 Pro Tip

Salesforce Stock Analysis 2025 – Growth, AI Bets & Buy the Dip?

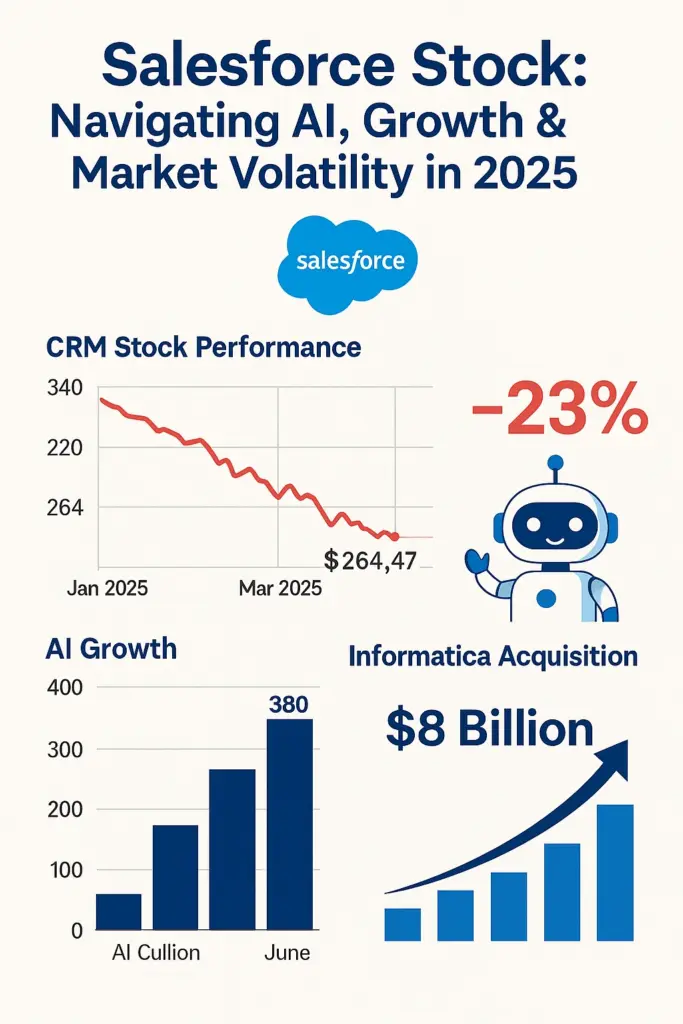

Salesforce stock (CRM) is down 23% YTD despite strong AI momentum. Is it a buying opportunity or a sign of deeper issues? Full 2025 investment guide here.

Infographic Description:

This digital infographic, titled “Salesforce Stock in 2025: AI Growth vs. Market Reality”, offers a visually engaging overview of Salesforce’s current stock situation. It features:

- A bold title header with the Salesforce logo and the tagline “Buy the Dip?”

- A line graph illustrating Salesforce’s stock price drop of 23% YTD

- Key data points like Q1 FY2026 earnings ($9.83B revenue, $2.58 EPS)

- A visual breakdown of the $8B Informatica acquisition

- A timeline showing the evolution and adoption of Agentforce, Salesforce’s new AI platform

- Analyst ratings and price targets from Wedbush, Needham, and Bank of America

- A clear split between Bullish and Bearish factors to help investors weigh pros and cons

The design uses a corporate color palette (blue, grey, white) with AI and cloud-themed graphics, offering both professionals and casual investors a quick yet comprehensive summary of Salesforce’s 2025 investment story.

📌 Introduction

Salesforce (NYSE: CRM), the global leader in Customer Relationship Management (CRM) software, has long been a favorite among tech investors due to its steady growth, enterprise dominance, and strategic M&A moves. However, in 2025, Salesforce stock finds itself in turbulent waters — trading down over 23% YTD as of June 4, despite impressive strides in artificial intelligence (AI) and robust earnings.

So, what’s happening beneath the surface, and is now the time to buy the dip? Let’s unpack the numbers, growth story, and market sentiment to evaluate whether Salesforce stock deserves a place in your portfolio.

💼 Company Overview

- Ticker: CRM

- Market Cap: ~$256 Billion (as of June 2025)

- Headquarters: San Francisco, CA

- CEO: Marc Benioff

- Core Offerings: CRM software, Slack, Data Cloud, Marketing Cloud, and newly launched AI platform Agentforce.

Salesforce dominates the CRM market, holding nearly 23% global market share. Its strategic acquisitions—like Slack, Tableau, and most recently Informatica for $8B—have helped it expand beyond CRM into data integration, analytics, and AI.

📉 2025 Stock Performance

Despite a strong Q1 showing, Salesforce stock has slumped due to a combination of soft forward guidance, acquisition worries, and macroeconomic caution.

🔍 Key Metrics – Q1 FY2026 (Reported May 29, 2025):

- Revenue: $9.83 Billion (↑ 11% YoY)

- EPS (Adjusted): $2.58 (↑ 44% YoY)

- Operating Margin: 23%

- Cash & Equivalents: $13.5 Billion

- Full-Year Guidance: $40.5B–$40.9B (vs. $41.35B analyst expectation)

Despite topping earnings estimates, the weak forward guidance and Informatica acquisition spooked investors, resulting in CRM stock’s biggest single-day drop since 2022.

🤖 AI Momentum: Agentforce Is the Next Big Bet

In 2025, Salesforce is aggressively positioning itself in the AI landscape through Agentforce, a new platform combining generative AI, automation, and predictive intelligence across its ecosystem.

- 380,000 AI interactions recorded in Q1

- 3,000+ paying customers onboarded

- Expected to materially impact revenue by FY2027

Agentforce aims to reduce customer support costs, streamline marketing efforts, and enable smarter sales strategies. While impressive, Wall Street remains cautious — the AI payoff is still 1–2 years out.

💰 Acquisition Strategy: Bold or Risky?

Salesforce’s $8B purchase of Informatica is designed to strengthen its data layer and enhance AI functionality. However, the market remains skeptical given:

- Underwhelming post-acquisition impact from Slack

- Concerns about Salesforce’s overreliance on M&A for innovation

- Dilution risks & integration challenges

This acquisition spree, though strategically aligned with its AI roadmap, has drawn criticism from analysts worried about Salesforce’s organic growth slowdown.

📊 Analyst Sentiment

| Firm | Rating | Target Price | Commentary |

|---|---|---|---|

| Wedbush | Outperform | $425 | “AI wave is real, Salesforce is a core beneficiary.” |

| Needham | Buy | $390 | “Top enterprise pick for 2025, Agentforce will scale.” |

| Bank of America | Neutral | $288 | “Demand slowdown, guidance issues create caution.” |

The analyst consensus remains moderately bullish, but not without warnings about short-term volatility and execution risks.

📈 Valuation Snapshot

- P/E (Forward): 26x

- EV/EBITDA: ~20x

- Price/Sales: ~6.5x

- PEG Ratio: ~1.5

Compared to historical valuations, Salesforce appears modestly undervalued, especially if Agentforce delivers in FY2027+.

🛒 Should You Buy the Dip?

✅ Bull Case:

- Leadership in CRM and enterprise SaaS

- First-mover advantage in integrated AI (Agentforce)

- Strong balance sheet and operating margins

- Potential rebound once AI monetization kicks in

Read More Blog like This :CDSL Shares Zoom 20% to Hit Fresh Record High on Bonus Announcement

❌ Bear Case:

- Weak FY2026 guidance

- Market weary of M&A spending

- Macro uncertainty in enterprise IT budgets

- Intense AI competition (Microsoft, Oracle, Adobe)

🧠 Final Verdict

Salesforce is a long-term play on enterprise AI. While the recent stock dip reflects short-term headwinds, it could be an attractive entry point for growth-oriented investors with patience.

If you believe in the future of AI-powered business software and Salesforce’s execution ability, this correction could be an opportunity to buy a future leader at a discount. However, expect volatility and a slow burn before major upside materializes.

For More Information visit: https://finance.yahoo.com/quote/CRM/

📌 Pro Tip

Dollar-cost averaging (DCA) into CRM could be a smart way to build a position over time, especially if you’re worried about catching a falling knife. Keep an eye on Q2 results and Agentforce monetization metrics.

I’m Alex, the creator of TricksEarn — a website where you’ll find the latest loot deals, free recharge tricks, cashBack offers, and smart money-saving tips. I started this platform to help people get the most out of online shopping, apps, and promo deals — without wasting time or money.

With a passion for technology, deals, and digital hacks, I work every day to bring you verified offers that actually work. Whether you’re a student looking for free data or someone who loves grabbing deals before they expire, TricksEarn is here to help.

Join our growing family on Telegram @tricksearnofficial to stay updated with instant alerts on loot deals and giveaways!

Thank you for visiting TricksEarn — let's save smart, together.

![FREE Google Play Redeem Codes Giveaway Of 22th June 2024[ 100% Working] free google play redeem codes 22th june 2024](https://tricksearn.com/wp-content/uploads/2024/04/Screenshot-2024-06-22-at-7.52.42-AM-218x150.png)

![Paytm New Data Recharge Offer – Get Flat 10 Cashback [June 2025 Special promo code] Paytm New Data Recharge Offer 2025](https://tricksearn.com/wp-content/uploads/2025/06/ChatGPT-Image-Jun-4-2025-01_23_46-AM-100x70.webp)